Finalising Basel III YouTube

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the.

3. Basel III capital charges. Download Scientific Diagram

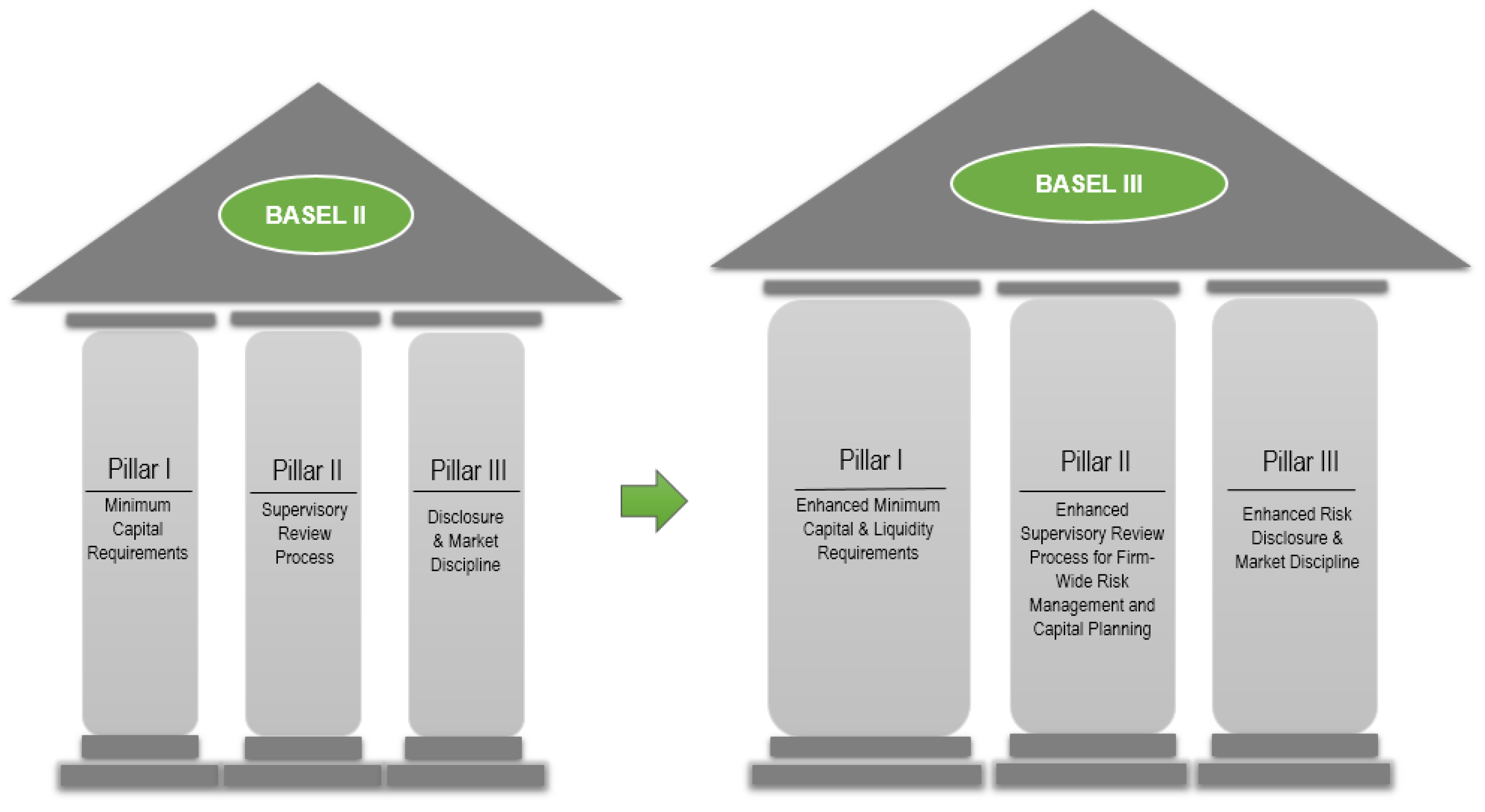

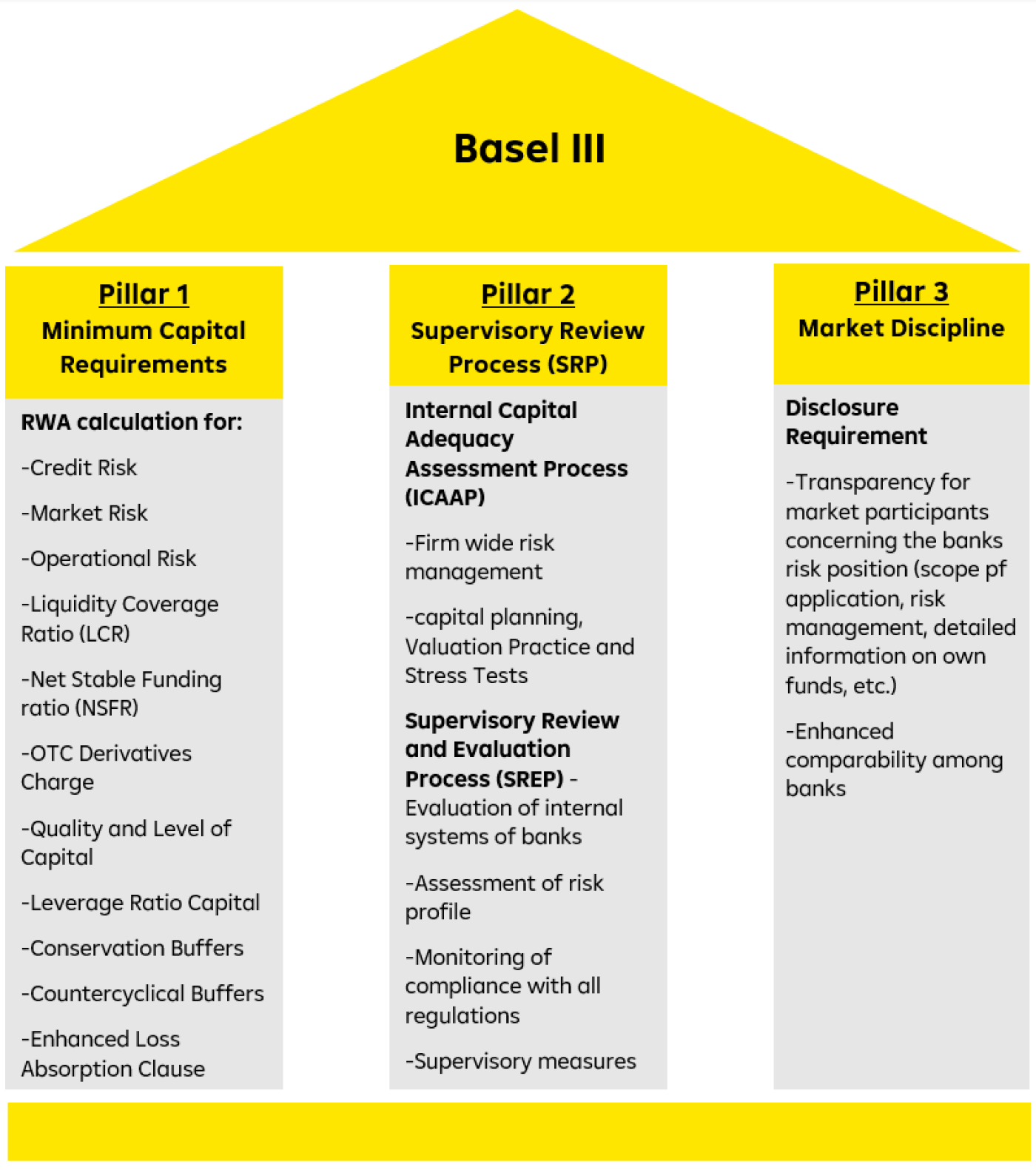

The Basel III framework is a central element of the Basel Committee's response to the global financial crisis. It addresses shortcomings of the pre-crisis regulatory framework and provides a regulatory foundation for a resilient banking system that supports the real economy. A key objective of the revisions incorporated into the framework is to.

Basel III’s final reforms explanation in a nutshell AAA Riskfinance

Finalising post crisis reforms: Basel III implementation and further improvements. 08/02/2022. Presentation by. Martin Merlin. Organisation. Director, Banking, insurance and financial crime, DG FISMA - Financial Stability, Financial Services and Capital Markets Union, European Commission. 2022-02-10 08:19:09 +0100.

Israbi Basel Iii Pillars

Basel 3.1. Basel 3.1 is part of a package of global reforms. In response to the global financial crisis of 2007-2008, the Basel Committee on Banking Supervision (BCBS) agreed a series of changes to its standards. These reforms, widely known as Basel III, were intended to improve the resilience of internationally active banks.

Basel III Post Crisis Reforms YouTube

guide post-crisis global reforms. The BCBS published the final documents on the Basel III Finalisation package in. The go-live date of the Basel III reforms has been formally deferred by the BCBS by one year due to the COVID-19 crisis, from the originally planned implementation date of January 2022, to January 2023..

PPT BASEL III PowerPoint Presentation, free download ID276553

Finalised Basel III: Post-crisis reforms LEVERAGE RATIO FRAMEWORK LEV 10 - 40 Refinements to the Leverage Ratio (LR) exposure measure The LR will restrict the accumulation of leverage that amplifies downward pressure on asset prices as banks rush to deleverage in times of financial crisis and strengthen the risk-based capital requirements as a

Why finalising Basel III is good for the European banking sector CEPS

International Material. BCBS - Basel Committee on Banking Supervision. Standards. 2017. Basel III: Finalising post-crisis reforms (Dec 2017) Next. Published date: 7 December 2017.

Basel III Finalising PostCrisis Reforms (FRM Part 2 2023 Book 3 Chapter 22) YouTube

Committee on Banking Supervision (BCBS) package in the EU, given the essential goals of finalising the post-crisis reform agenda and supporting multilateralism. At the same time, the BSG recommends that the transposition of Basel III final reforms duly takes into consideration the European specificities, in

Presentations Basel Analytics

Basel III

This press release was modified on 6 December 2023 to add the final texts of the provisional agreement. The EU is about to boost the resilience of banks operating in the Union and strengthen their supervision and risk management by finalising the implementation of the globally agreed Basel III regulatory reforms. Today, negotiators from the Council presidency and the European Parliament.

Basel IV as the Finalization of Basel III Reform Explained

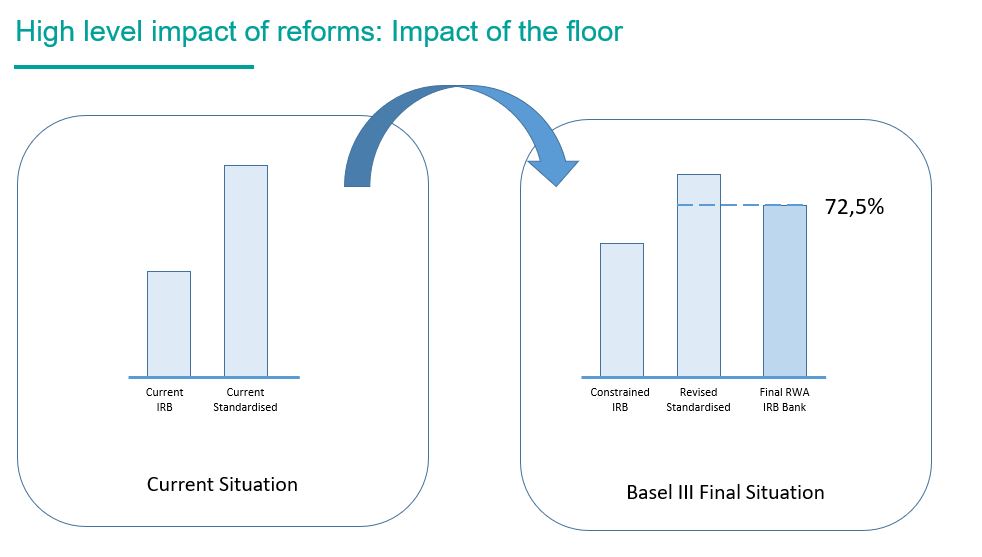

Table 1: Source: Basel III: Finalising post-crisis reforms (BCBS 424) • Removing use of A-IRB for specific asset classes (e.g. Large and mid-sized corporates (consolidated revenues > €500m), banks)

Proposed Changes to Basel III Leverage Ratio Framework

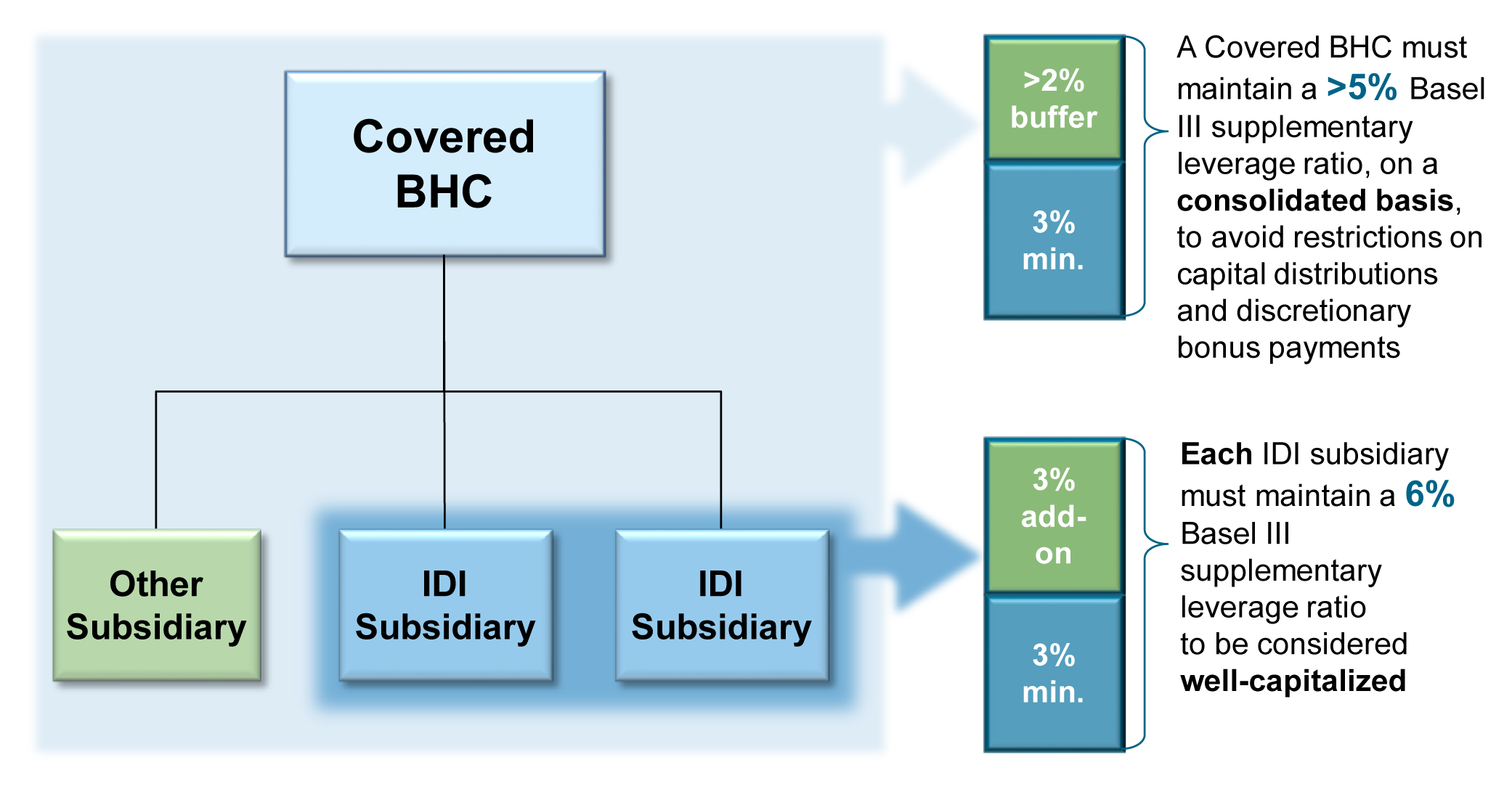

The finalised Basel III reforms introduce a leverage ratio buffer for global systemically important banks (G-SIBs) which comes on top of the minimum leverage ratio requirement for all banks: The leverage ratio G-SIB buffer must be met with Tier 1 capital and is set at 50% of a G-SIB's risk-weighted higher-loss absorbency requirements.

:max_bytes(150000):strip_icc()/What-minimum-capital-Adequacy-ratio-must-be-attained-under-basel-iii_final_rev_-1ba1b2672e0a4a8284d94a9d2b7b52fa.png)

What Is the Minimum Capital Adequacy Ratio Under Basel III?

Basel III: Finalising post -crisis reforms 5 8. At national discretion, a lower risk weight may be applied to banks' exposures to their sovereign (or central bank) of incorporation denominated in domestic currency and funded. 7. in that currency. 8. Where

(PDF) Stability and Sustainability in Banking Reform Are Environmental Risks Missing in Basel III?

The package of reforms commonly known as 'Basel III' is a comprehensive set of measures developed by the Basel Committee on Banking Supervision (BCBS), with this framework being a central element of the response to the global financial crisis. It aims to address a number of shortcomings in the pre-crisis regulatory framework whilst.

.jpg)

Finalising Basel III Stability through reform International Council of Securities Associations

The Basel III standards are minimum requirements which apply to internationally active banks, which ensure a global level playing field on financial regulation.. Basel III: Finalising post-crisis reforms (December 2017) not yet transposed in EU legislation: Minimum capital requirements for market risk (January 2016, revised January 2019)

Basel Committee urges full, timely and consistent implementation of Basel III postcrisis

The last leg of the Basel reforms plays an important role in ensuring our regulatory framework is fit for purpose to tackle any medium and longer-term vulnerabilities. The remaining reforms are proposed for longer-term systemic and structural reasons well-grounded in the lessons learned from the Great Financial Crisis.

- Fear The Walking Dead 5x16 Online

- Museo De La Tolerancia Costo Domingo

- Kimbo Slice Vs Brock Lesnar Ufc 2010

- Jugadores Jovenes Con Face Real Fifa 17

- Poblacion San Miguel De Allende

- La Leyenda De Ip Man

- Formacion De La Orina Pdf

- Norma De Calidad Iso 9001 Version 2015 Pdf

- Cultura Maya Economia Y Religion

- Ejemplos De Objetivos Especificos De Una Investigacion Cuantitativa